Bookmaker - What Is It And How Does It Work?

Under normal conditions, the bookmaker is the only component of a wager that is certain to win. To stay in business, bookmakers must create wagers that profit them each time they provide a wager.

Author:David MitchellReviewer:Henrik SchmidtApr 19, 202295 Shares1.5K Views

To stay in business, bookmakersmust create wagers that profit them each time they provide a wager. As a result, bookmakers do not set odds solely on the basis of probability. Additionally, they integrate a margin to ensure they earn a profit on each wager.

Example

Consider the following example of a simple coin toss for £100:

Because the outcome is either heads or tails, the probability is 50/50. One individual wagers on heads, while the other wagers on tails. Whoever wins, the bookmaker must pay out the £100, leaving him with no profit.

That would be an extremely poor business strategy. As a result, the bookmaker reduces the prize money.

Assume now that the bookmaker reduces the payout to £90 rather than the reasonable £100. This is similar to offering 1.90 odds rather than the more reasonable 2.00. Because our two punters are still betting £100 each, the bookie will benefit regardless of the outcome, as he will take £100 from one punter and pay out £90 to the other, keeping £10 for himself.

This is the bookmaker's margin, commonly known as the commission, the "Vig," or "juice," in the United States. And it is just this aspect of betting that makes it so difficult, since you must not only choose winners, but also do it at a rate of return greater than the bookmaker's margin.

Conquering The Margin

How Is This Possible?

As you can see, when individuals talk about "beating the bookmaker," what they mean is that long-term betting success requires beating the bookmaker's margin.

It is referred to by a variety of terms, including the juice, the vig, the margin, the commission, the take, the percentage, and the cut. Whatever you want to call it, it's the slice of activity that every bookmaker extracts from the odds in order to justify their existence.

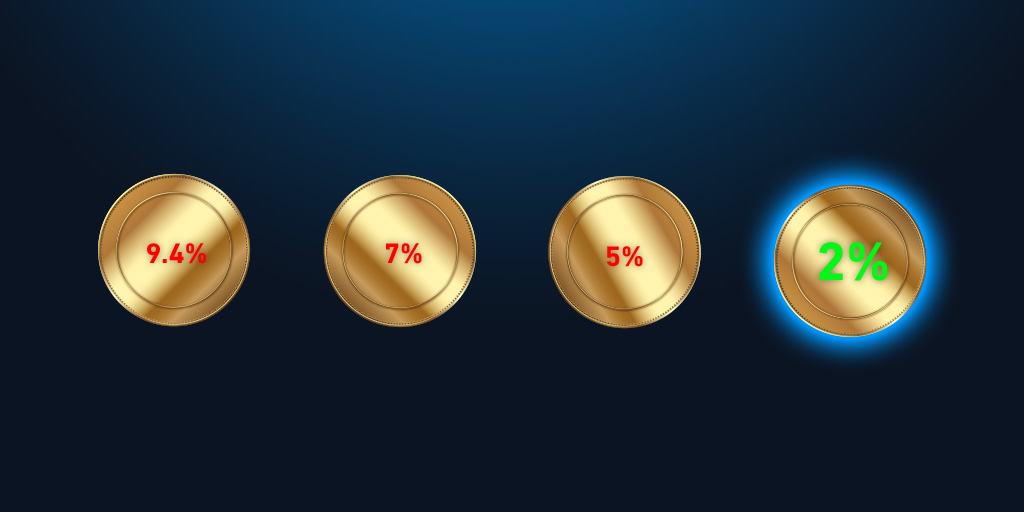

And it varies by bookmaker and even by event, with bookmakers occasionally giving special "reduced juice" on specific leagues or tournaments in order to attract clients, offering bettors better odds and returns than those offered by competing bookmakers.

However, what are the betting margins for bookmakers? How are they calculated? How much commission do you charge for every wager, and how does this affect your betting profits?

What Is The Meaning Of Bookmaker Margins?

Some feel that bookmakers are "risk takers," that the odds they offer are more indicative of who the bookmaker believes will win a particular race, and that bookmakers, in essence, have a favorite winner in any given fight. This is just partially accurate.

While bookmakers may have a preference for a particular winner in any specific contest, this is not due to a preference for one side when setting the odds. And a bookmaker is not a risk-taker.

When bookmakers establish odds for a specific event, they seek to set odds that will encourage betting on both sides of the market, thus balancing the bookmaker's responsibility in light of the various outcomes.

However, since a bookmaker's obligation is equivalent to any outcome, how does the bookmaker profit? Of course, the margin is the answer.

Bookmakers deduct this portion from the odds they offer, resulting in a profit, or "margin," once their obligation on both sides of the odds is balanced. In other words, the margin is the percentage of money that the bookmaker will demand from bettors if their liability is perfectly balanced. And, while it is improbable that a bookmaker will achieve perfectly balanced liability on each side of a particular event, by offering hundreds of markets each day on a wide variety of sporting events, they can be confident that their overall liability will balance out and they will be able to collect their cut of the money bet by bettors.

What Is An Equitable Market?

So, what is an example of a market that has been stripped of its bookmaker margin? To begin with, the most obvious example is the so-called "even money" occurrences. This is where the bookmaker believes that both sides of the market will receive equal action from a betting public that believes each result has a 50-50 chance of occurring.

As an illustration, consider tossing a coin. They may anticipate that, given a sufficient number of tosses, a coin will land on its head half as often as it will land on its tails. If bookies offered a true market without a buffer, the chances of heads and tails would, of course, be an even 2.00. That is, you wager $1.00 in order to gain $1.00. This is referred to as a "100% market" or "fair odds." In other words, you will receive the full value of your investment.

However, bookmakers also want a piece of the action. After all, they are in business to make money. To accomplish this, they offer them odds ranging from 1.85 to 1.99 as "even money." They deduct their commission. They do not charge the entire amount. This is a business transaction.

Thus, if they were given fair odds of 2.00 on a coin toss, which is essentially a 50-50 event, it is likely that they would not lose any money over a sample size of thousands of £1 bets. They will win 50% of the time, earning a profit of £1.50. They will lose 50% of the time, resulting in a loss of £1.50. However, a bookmaker will not provide the with these odds. They are in business to make money, which means they are more than likely to offer them odds of 1.90 for a coin flip. This indicates that for every £1 wagered, they will receive an average of £0.90 in return, averaging a loss of £0.10, as the bookmaker claims. This is how they profit: by not offering reasonable odds on a particular result.

Calculating The Margin Of Safety In The Betting Market

As previously stated, a 100 percent market is one in which "fair odds" are supplied. It is a situation in which neither the betor nor the bookmaker gains an advantage. When the market is deemed to be less than 100%, the bettor gains an advantage, as the odds are worth more than the probability of all conceivable outcomes. On the other hand, when the market is larger than 100%, as it frequently is, it indicates that the market has less than full worth. The bookmaker has the advantage.

Thus, how can they determine the margin for a particular betting market?

To be honest, it's fairly straightforward math. To begin, they must convert the decimal odds to the percentage probabilities they reflect, sometimes referred to as their "implied likelihood."

Thus, let's consider the odds of 1.65. They just divide these chances by 1.65, which equals 0.606. This is repeated for each conceivable outcome in the event, added together, and multiplied by 100 to obtain the market percentage, also referred to as the "overround."

Here is an illustration: Consider a footballgame with three possible outcomes: the team wins, the team loses, or the game is a draw.

- The odds for Team 1 are 2.00.

- The draw odds are 3.903.50.

They perform our conversions and obtain the likelihood of team 1: 1/1 = 0.500 Team 2's probability is 1 divided by 3.90, which equals 0.256.Probability of drawing: 1 divided by 3.50 equals 0.2861.042 = total The market margin is 104.2 percent.

Now, given the margin, determine the average fee you pay on each bet. The commission on certain odds can be calculated in a variety of ways. Our preferred procedure is as follows:

* 100% commission = (1 – (1 / Market Margin))

– (1/1.042)Commission (1-0.96) = Commission (1-0.96) * 100% = Commission 4%

Thus, for every £100 wagered, you pay an average of £4 to the bookmaker. Alternatively, at a 4% commission rate, you would be offered odds of 1.92 on a coin flip.

Of course, you don't want to have to do this every time you wish to place a wager, particularly if you're attempting to value a horse racing market with 12 or more horses. Thankfully, betting exchanges such as Betfair indicate the market margin for each market. Additionally, there are a variety of calculators available online that will perform this task for you. In other words, choosing five winners out of ten at fair odds of 2.00 would net you a profit. However, if you take regular bookmaker odds of 1.90 and subtract a 0.10 fee from the fair odds of 2.00, picking five wins results in a 5% loss on your overall investment. They wager ten units and select five winners at a rate of two dollars for each winner. Five winners multiplied by 2.00 equals a return of ten. They break even on our ten-unit investment. However, using the typical bookmaker charge of 5% on odds of 2.00, they earn a return of 1.90. 5.05 multiplied by 1.90 equals a return of 9.5. They incur a 0.5 loss. or, in other words, 5% of our ten-unit investment.

How To Beat The Bookies With Draws (the most profitable soccer betting system)

Conclusion

If you're looking for a more accurate indication of the value of a bet, you might want to check out the section on betting on exchanges such as Betfair and Betdaq. Users wager against other users on a betting exchange, and the market is driven solely by supply and demand, frequently resulting in better odds than those offered by bookmakers. However, it is critical to keep in mind that exchanges charge between 2% and 5% commission on winning bets, which means that pricing may appear more favorable than it actually is when commission is factored in. The commission is conceptually similar to the bookmaker's margin, but most bookmakers build in a higher margin than 5%, which means you're almost always better off using a betting exchange.

David Mitchell

Author

David Mitchell is a versatile writer at Tennessee Independent, specializing in news, sports, and player profiles. With a keen eye for detail and a passion for storytelling, David brings a unique perspective to his articles, covering a wide range of topics that resonate with readers. His expertise in these areas ensures that readers receive insightful and engaging content, making him a valuable asset to the Tennessee Independent team.

Henrik Schmidt

Reviewer

Henrik Schmidt is a dedicated writer focusing on sports, betting, and various entertainment aspects related to the sporting world. With a passion for exploring the intersections of sports and entertainment, Henrik brings a unique perspective to his articles. His expertise in these areas ensures that readers receive informative and engaging content, making him a valuable contributor to the sporting community.

Latest Articles

Popular Articles